The 1980s Economy, What Was Really Going On Behind The Neon

Close your eyes for a second and think about the 1980s.

You probably see music videos on MTV, cassette tapes on the floor of your bedroom, maybe the mall on a Saturday, maybe you hear the “whoosh” of the VCR when you pushed a tape in. That is the version of the eighties we remember.

What most of us did not see as kids, was the economic chaos in the background. The stress at the kitchen table. The bills. The interest rates. The layoffs.

Now here we are, raising kids in a world where they hear about “inflation” and “the economy” on TikTok before they ever sit through a news broadcast. And suddenly it helps to understand what was actually going on in the decade that shaped our money mindset.

This is the grown up breakdown of the 1980s economy, in human language, not textbook language.

We Were Kids In A Recession And Did Not Even Know It

The eighties did not start as a feel good montage.

The United States slid into the decade in rough shape. Unemployment was high, prices were still rising, interest rates were sky high, and a lot of families were one car repair away from real trouble. Your parents might have been juggling bills while you were stretched out on the floor watching cartoons, completely unaware.

When Ronald Reagan took office in 1981, he walked into that mess. His administration brought in a plan that later got nicknamed “Reaganomics.” The basic idea was simple to explain, even if it was messy to live through, lower taxes, less regulation, let businesses breathe, and hope that growth would follow.

The recovery did not happen instantly. The early eighties still felt tight for many families. But those policies helped set the stage for the big economic rebound that came later in the decade.

If you want a way to explain this to your kid, try this,

“Imagine the whole economy is a game that keeps freezing. They changed the settings so it would run better later, but people had to live through the glitchy part first.”

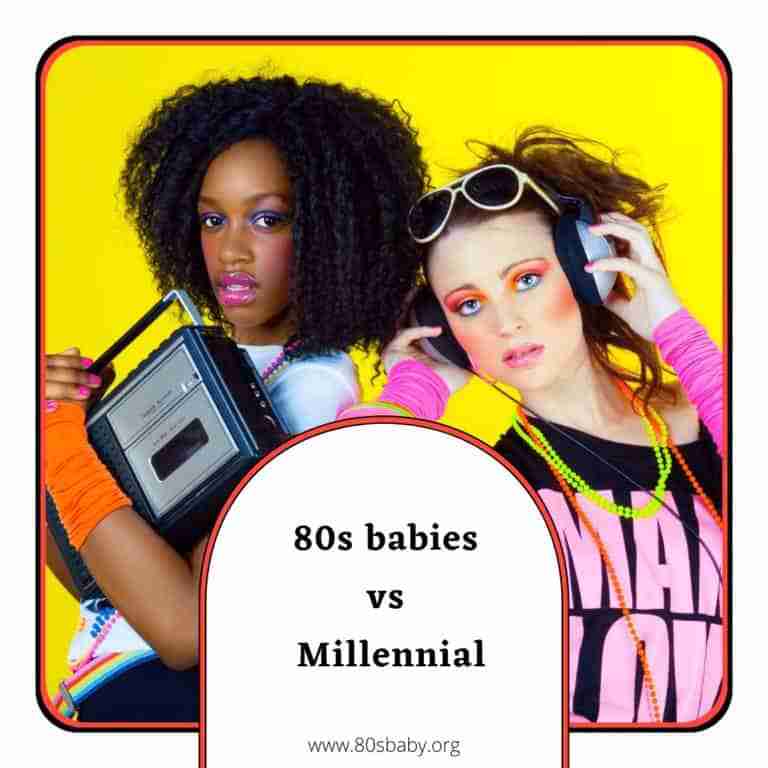

Culture Looked Rich, Even When Wallets Did Not

Here is where the eighties get confusing.

Money was tight in a lot of homes, but the culture looked loud and luxurious. MTV was changing how we discovered music. Movies like “Back To The Future,” “E T,” “Star Wars” sequels, and “Ghostbusters” made everything feel huge and exciting. Fashion was big, bold, and sometimes kind of ridiculous in the best way.

And then there were the “yuppies,” young urban professionals, the briefcases, the suits, the car phones, the idea that you could work your way into that glossy version of success.

So on one side, you had parents quietly stressing about mortgages and layoffs. On the other, you had music videos and movies selling a life that looked like endless money and fun.

When your kids ask how that can be, you can tell them the truth,

“The eighties looked rich on screen, but in real life a lot of people were just trying to stay afloat.”

Why The Early Eighties Recession Really Happened

The recession that dragged through the early eighties did not just appear out of thin air.

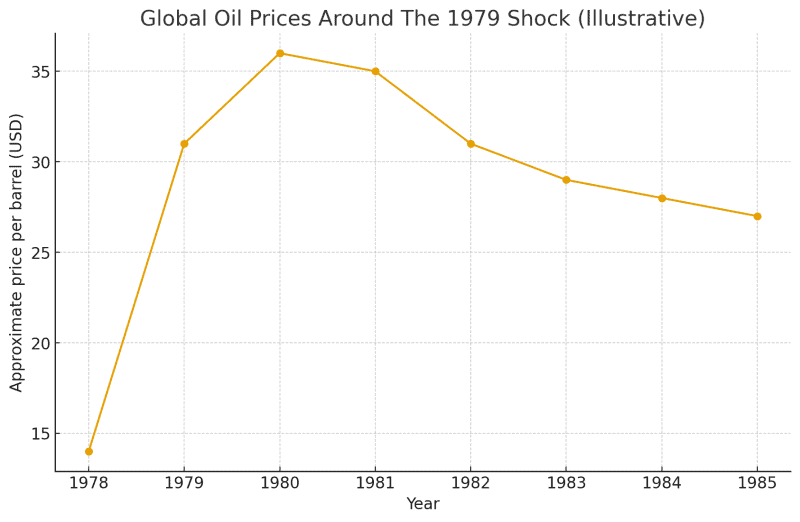

A huge piece of the story is the 1979 oil crisis. When the Iranian Revolution disrupted oil production, the price of oil shot up. And when oil goes up, pretty much everything goes up, gas, shipping, food, heating your house, manufacturing.

To fight rising prices, central banks made borrowing money more expensive. That is great if you are trying to slow inflation, but it is painful for regular people and small businesses. Companies pulled back. Factories slowed down or shut down. People lost jobs.

By 1982, the World Bank was calling it a global recession. Some countries did not really recover until the middle of the decade.

To make this real for a teen, you might say,

“Imagine the price of gas, food, and deliveries all jump at the same time, and then on top of that, your credit card and loans suddenly cost way more. That is what a lot of people were facing in the early eighties.”

Venezuela, When An Eighties Problem Becomes A Long Term Crisis

If you want to show your kids that these things have long shadows, Venezuela is a powerful example.

For a long time, Venezuela had one of the strongest economies in Latin America because of its oil. When oil prices fell in the eighties, it was like someone pulled the plug on their main source of power. Inflation rose. Debt increased. The currency weakened.

Those problems, mixed with political corruption and bad decisions, created cracks that kept widening. The humanitarian crisis we see there now did not start in one year. The eighties were one of the turning points, the moment when the strong foundation started to break.

It is a clear way to explain to your kids what can happen when a country leans too hard on one resource or one industry.

The United States Bounces Back

Here is the twist, the United States actually recovered faster than a lot of other countries.

By around 1983, the recession was officially over. Inflation cooled off. People slowly started spending again. You can almost see that shift reflected in the tone of the commercials and the confidence of the music from the mid to late eighties.

New industries started to step into the spotlight,

finance, with Wall Street and big investing culture,

technology, with more computers showing up in offices and eventually in homes,

entertainment and media, with cable television expanding options,

telecommunications, more phone lines, more long distance, more global connection.

At the same time, traditional manufacturing jobs were shrinking. The service economy was growing. More office work. More customer service work. More jobs where you were dealing with information rather than machines.

By the late eighties, the American economy had a new shape, more global, more digital, more focused on services than factories. That is the world our kids were born into, even if they have no idea where it came from.

The Long Shadow Of The 1979 Oil Crisis

If there is one thing you want your kids to understand, it is that the 1979 oil crisis did not just mean “people waited in gas lines.”

When the Iranian Revolution cut oil production, prices doubled. Then the Iran Iraq war that followed kept everything unstable. That shock hit almost every part of life,

higher prices for basic goods,

slower growth,

more stress on governments that were trying to keep things under control.

Many countries spent the entire decade trying to adjust to that one punch. Some were still feeling it into the next decade.

You can frame it like this,

“One big change in one resource can shake entire countries, even countries that are nowhere near where the problem started.”

Reagan’s Role, Outside The Slogans

People still argue about Ronald Reagan and his economic choices, but we can keep this part simple.

His administration focused on a few main things,

cutting income taxes,

lowering corporate taxes,

loosening rules on certain industries,

supporting a strict approach to money policy to bring inflation down.

People who support that approach say it helped the economy grow, encouraged investment, and finally got inflation under control. People who criticize it say it pushed the national debt up and pushed inequality higher.

You do not have to pick a side in order to understand the impact. Reagan’s approach changed how the United States thought about taxes, government spending, and markets for decades after. Your kids are living in a world shaped by those choices, even if they have never seen a single Reagan speech.

How To Turn All Of This Into A Real Conversation With Your Kids

This is where you turn history into connection.

Your kids are growing up in their own version of uncertainty. They hear words like inflation, recession, student loans, housing crisis. That can feel big and abstract. The eighties give you a story to connect those ideas to real life.

You might start with something like,

“When I was your age, the adults around me were dealing with a recession and wild interest rates, but nobody really explained it. I just saw the stress. I do not want that for you, so let me tell you what was actually going on back then.”

Then you can connect dots between then and now,

how your parents handled money versus how you are trying to handle it,

how jobs shifted from factories and local shops to offices and online work,

how one oil shock changed prices everywhere, just like one factory shutting down or one war can still move prices today.

Kids may not care about “economic theory,” but they care about whether they will be able to afford an apartment, pay off school, or get a job that does not burn them out. When you tell them,

“We lived through a big transition too, we just did not have the language for it,”

you give them context and comfort at the same time.

Final Thoughts, More Than A Vibe

The 1980s were more than neon colors and movie soundtracks.

The decade started in recession and anxiety. It moved through pain and adjustment. It ended with recovery, new industries, and a very different idea of what a “normal” economy looks like.

We grew up inside that shift without realizing it. Now we are raising kids in the world it created.

So no, the eighties were not just fun montages and mall scenes. They were a turning point. And when we can tell that story clearly, we are not just being nostalgic, we are building a bridge between our analog childhood and our kids’ digital world.